How Does ERP Support Accounting and Finance?

How Does ERP Support Accounting and Finance?

Finances are the lifeblood of your business. You and your leaders need access to real-time financial information to make the business-critical decisions that drive profits and growth. There are accounting solutions that can meet basic financial needs; however, a growing business needs more than that. You’ve heard about enterprise resource planning (ERP) and you may be wondering how does ERP support accounting and finance operations?

There are a lot of financial transactions and figures to track across your organization, and not just in the accounting department. In addition to basic accounts receivable and payable, you need to know the value of inventory in the warehouse, product profit margins, project costs, employee expenses and more to tell the whole story. Complex general ledgers are a constant battle for basic accounting software. Tracking and analyzing every incoming and outgoing dollar, in a way that makes sense for your unique structure, is essential to managing a profitable business.

3 Benefits of ERP for Accounting and Finance Departments

An ERP solution is far more efficient and robust than basic accounting software on many levels. The primary benefit for using ERP is that this business technology is integrated. You can manage it all from a single solution versus having to go to different systems or employees for the information you need. By aggregating and centralizing data from across your organization, you get a single source of truth and a complete financial picture.

Here are three additional benefits to using ERP to support accounting and finance operations:

- Automation and workflows: ERP includes built-in workflows and other time-saving automations that streamline data entry. Employees are guided through processes so that information is entered in the same way, consistently and accurately. Data is shared and accessible from and to other departments so you aren’t wasting time rekeying data from one system into another. Your people will save time and your business leaders will be confident they have up-to-date, accurate infromation.

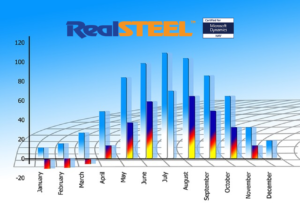

- Business intelligence features: Dashboards, charts and graphs, and detailed reporting put data at your fingertips. Monitor key performance indicators (KPIs) in real-time and respond faster to new opportunities or deviations in plans. Notifications alert managers when certain situations arise, such as when budgets are close to being exhausted or payments haven’t been approved.

- Robust reporting capabilities: Businesses spend a lot of time preparing financial reports for owners, shareholders, banks, tax and regulatory agencies, and many others. ERP also includes built-in and customizable reporting that automatically populates data from within the system. Instead of compiling spreadsheets and reconciling data from multiple systems, you can quickly and easily do month end close, create accurate profit/loss statements or other financial reports on a moment’s notice.

Real-Time Data, Real-Time Insight

ERP delivers a crystal clear look into the fiscal health of your business and an efficient way to monitor and measure each aspect of the accounting process. You can dig deep into financial information to monitor costs, revenues and profit margins. Then, use this information to scale production, plan inventory or otherwise position your business for strong, profitable growth.